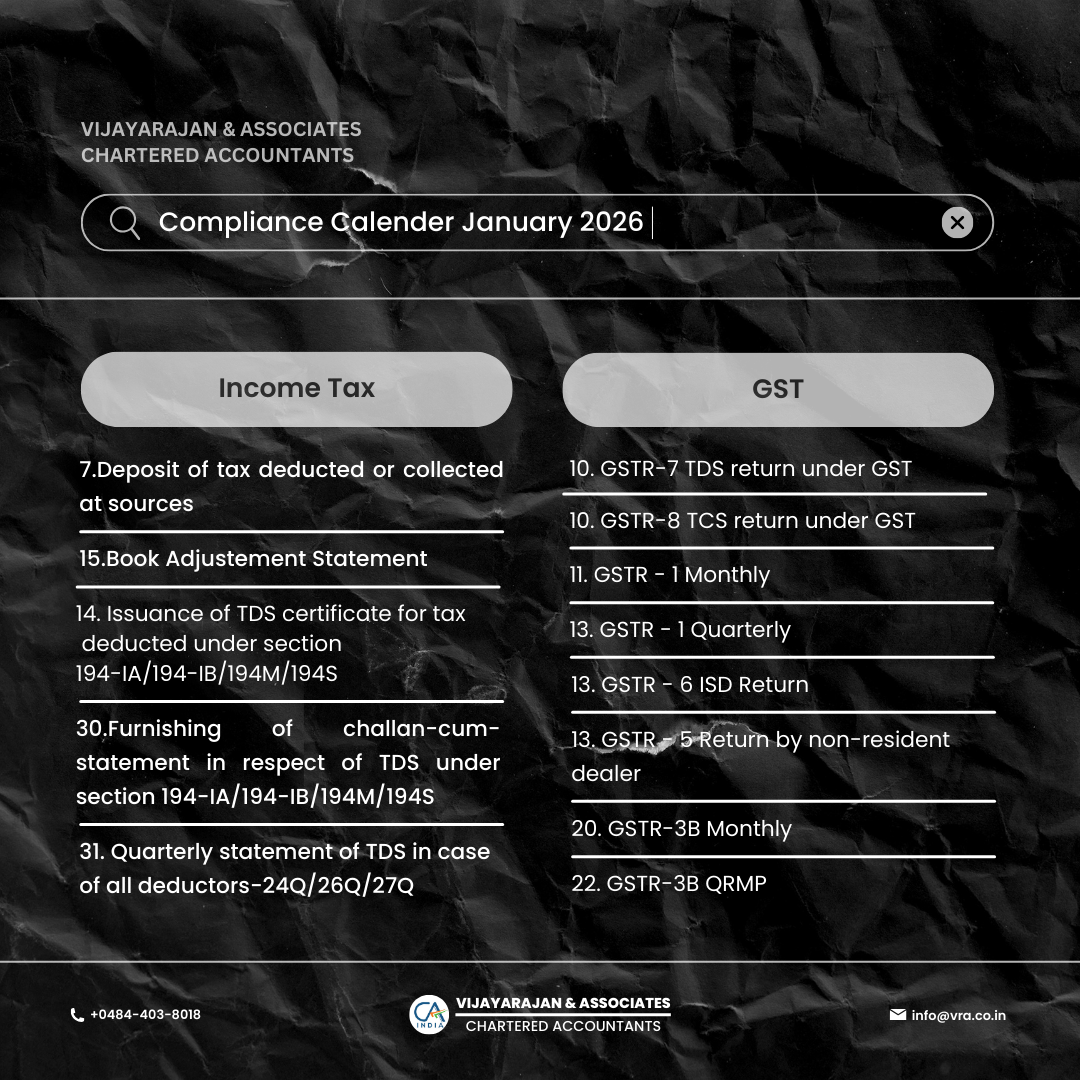

Vijayarajan & Associates - January 2026 Compliance Calendar – Key Tax, GST & Regulatory Deadlines

Stay updated with the January 2026 compliance calendar covering all important due dates for tax, GST, TDS, and regulatory filings in India. Avoid penalties by planning ahead.

·

1 min read

The January 2026 Compliance Calendar highlights all significant deadlines for Income-tax filings, GST returns applicable to businesses and professionals in India. Staying compliant on time helps prevent penalties, interest, and administrative challenges.

This Month’s Calendar Covers:

- Key due dates under the Income-tax Act

- Filing timelines for GST returns

This calendar is designed to help you plan ahead and meet your statutory obligations efficiently. Reviewing the upcoming deadlines early enables smoother operations and reduces the risk of missed compliance.

No comments yet. Login to start a new discussion Start a new discussion